Va cash out refinance with bad credit

It is one of the better mortgage programs available and a great benefit to our deserving veterans. When considering a VA refinance there are two options.

Va Cash Out Refinance Loan 2022 Guidelines Information

The minimum credit score is 500 with a maximum 80 LTV ratio.

. Fixed-rate Conventional Cash-out VA VA Streamline ARM Jumbo Navy Federal NLMS 399807 has mortgage refinancing options ranging from 10- to 30-year loan terms for their VA Streamline IRRL and Homebuyers Choice. Furthermore vehicles must be no older than 10 years with a maximum mileage of 125000 miles. VA loans are available with no down payment requirement for veterans active military and their spouses with credit scores as low as 500.

You pocket the difference between the two loans in cash. However youre much more likely to find lenders starting in the 580-600 range and even some as high as 600. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

The streamline refinance option is exclusive to homeowners with government-backed loans from the FHA VA or. Not affiliated with any government agency. True to its name this program also known as the Interest Rate.

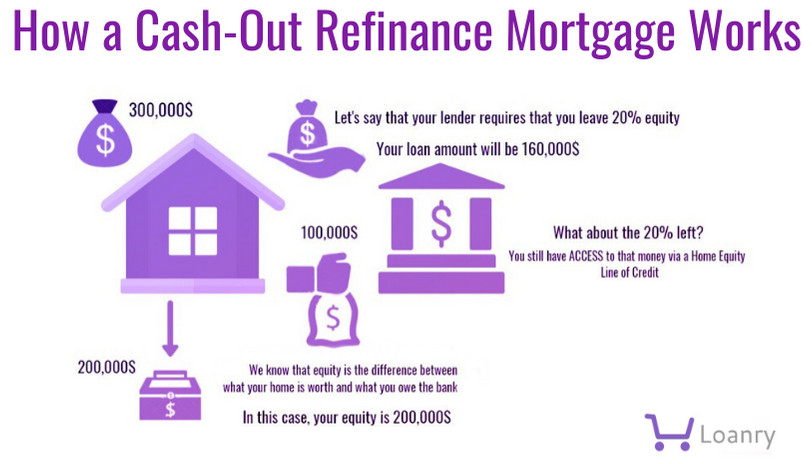

The minimum loan or refinance amount is 8000. VA Mortgage rates are extremely competitive but vary from lender to lender. A cash-out refinance also differs from a home equity line of credit HELOC which allows you to borrow cash using the home-equity as collateral.

In the US the Federal government created several programs or government sponsored. No minimum but lenders typically require 620. The VA also guarantees cash out refinance loans for eligible persons.

Requirements for an FHA cash-out refinance are more lenient than they are for conventional cash-out refinance loans. However VA lenders may impose their own minimum score requirements. Credit scores range from 300 which is.

30-Year Mortgage Rates Todays VA Refinance. These Refinance loan rates assume a loan-to-value ratio lower than 90. Before we dive into refinancing for bad credit lets first take a look at how your credit score impacts your refinance.

A cash-out refinance differs from a traditional mortgage refinancing which simply replaces your current loan with a new loan that has a new set of terms and in many cases a lower interest rate. Lenders use your credit score to determine how likely it is that you will pay them back in full and on time. VA loans do not have a minimum credit score.

To qualify you should have a minimum income of 1800 per month. 5500 6117 APR with 0750 discount points on a 60-day lock period for a 15-Year VA Cash-Out refinance. A streamline refinance or a cash-out refinance.

5500 6117 APR with 0750 discount points on a 60-day lock period for a 15-Year VA Cash-Out refinance and 5750 6096 APR with 0500 discount points on a 60-day lock period for a 30-Year VA Cash Out refinance. Technically you can get an FHA cash-out loan with a FICO score as low as 500. VA loans are typically offered with loan terms of 15 or 30 years.

When you apply to refinance your student loans one of the first things any lender will do is perform a credit check which includes a review of your credit score. Credit scores are generated by credit bureaus the three major bureaus are Experian Equifax and TransUnion based on data about your payment history on other loans and overall. VA loans are also available for credit scores as low as 500.

Here we dive into credit requirements and how borrowers can get a VA loan with bad credit. Note that FHA cash-out refinances are also limited to 80 percent of your homes value but with a VA cash-out. Mortgage Research Center LLC NMLS 1907.

Bad credit is OK as are dismissed or discharged bankruptcies. With a cash-out refinance you get a new mortgage that has a higher balance than what you currently owe on your existing loan. Browse todays VA mortgage rates and compare VA loan options.

Minimum credit score needed. Youll pay FHA closing costs and FHA mortgage insurance for a cash-out refi. VA Loan with Bad Credit Scores 500-620.

Bad credit poor credit or damaged credit can make qualifying for most business credit cardsor any credit cards for that matterdifficult.

Cash Out Refinance Best Sale 57 Off Www Wtashows Com

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Cash Out Refinance A Beginner S Guide Money Com

5 Options For Refinancing With Bad Credit Quicken Loans

Understanding Cash Out Refinancing When It S Appropriate Moneygeek Com

Can I Get A Bank Statement Cash Out Refinance Loan

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Home Refinance

Cash Out Refinance 500 Credit Score How To Get Approved

/Investopedia-terms-cash_out-refinance-V2-9b3bb93322934719ab4c5cfec6335f27.png)

Cash Out Refinance Definition

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Cash Out Refinance Clearance 50 Off Www Wtashows Com

Va Cash Out Refinance How Does It Work Forbes Advisor

Cash Out Refinance Definition

Va Cash Out Refinance In Medina Ohio

Cash Out Refinance Mortgage Refinance U S Bank

Cash Out Refinance To Use Your Home Like A Bank Loanry

Cash Out Refinance Explained Benefits Uses Requirements